Essential Forex Trading Tips for Beginners

If you are starting your journey in the foreign exchange market, you may feel overwhelmed by the amount of information available. Learning how to navigate Forex trading can be challenging, but with the right tips and strategies, you can set yourself up for success. This guide covers essential Forex trading tips for beginners, equipping you with knowledge to make informed trading decisions. We will also point you towards reliable resources such as forex trading tips for beginners Latam Web Trading to help you deepen your understanding.

Understanding the Basics of Forex Trading

Before diving into trading, it’s crucial to understand what Forex trading is all about. The Forex market is a global decentralized market where the world’s currencies are traded. Unlike stock markets, Forex operates 24 hours a day, five days a week, providing ample opportunities for traders worldwide. Learning fundamental concepts such as currency pairs, pips, and leverage will help you build a solid foundation.

Set Clear Goals

One of the first steps in your trading journey should be to set clear, achievable goals. Determining what you aim to accomplish can help provide a roadmap for your trading activities. Are you looking to make a full-time income, or are you interested in trading as a hobby? It’s essential to define your objectives, which will help you adopt a trading strategy that aligns with your goals.

Choose the Right Broker

Selecting a reliable Forex broker is a crucial aspect of successful trading. Research various brokers, looking for reviews and testimonials. Ensure the broker is regulated by a recognized authority, offers competitive spreads, and has a user-friendly trading platform. A good broker will also provide educational resources and customer support, which are particularly beneficial for beginners.

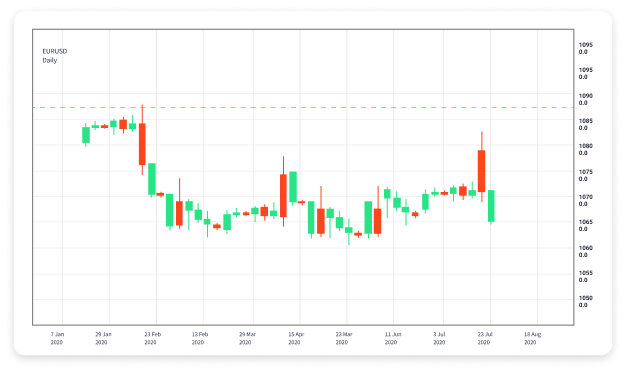

Learn Technical and Fundamental Analysis

Technical analysis involves studying price charts and patterns to forecast future price movements. Beginners should familiarize themselves with various chart types, technical indicators, and trading patterns. On the other hand, fundamental analysis focuses on economic indicators, interest rates, and geopolitical events that may influence currency values. Understanding both types of analysis can significantly enhance your trading decisions.

Practice with a Demo Account

Most Forex brokers offer demo accounts that allow you to trade with virtual currency. This is an excellent way for beginners to practice their skills and test strategies without risking real money. Use this opportunity to familiarize yourself with the trading platform, develop your trading plan, and gain confidence in your abilities.

Develop a Trading Strategy

A well-defined trading strategy is essential for succeeding in Forex trading. Your strategy should include aspects such as entry and exit points, risk management techniques, and the specific analysis used to make trading decisions. Stick to your trading plan and avoid making impulsive decisions based on emotions or market rumors.

Manage Your Risks Wisely

Risk management is critical in Forex trading, especially for beginners. One of the most common mistakes novice traders make is risking too much of their capital on a single trade. It’s essential to determine the amount you are willing to risk per trade and stick to it. Many traders recommend risking no more than 1-2% of their total trading capital on any given trade.

Keep Your Emotions in Check

Trading can be an emotional rollercoaster, especially when dealing with significant losses or unexpected market movements. It’s vital to maintain emotional discipline and not let fear or greed dictate your trading decisions. Establishing a routine, sticking to your trading plan, and continuously educating yourself can help you remain level-headed during trading.

Stay Informed and Keep Learning

The Forex market is constantly evolving, and staying updated with current market trends is crucial. Follow reputable financial news sources, read books, attend webinars, and engage with online trading communities to keep your knowledge fresh. Continuous learning will not only improve your trading skills but also enhance your ability to make informed decisions under varying market conditions.

Utilize Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for managing risk in Forex trading. A stop-loss order automatically closes your position once it reaches a specific loss threshold, while a take-profit order locks in profits when your target is met. Utilizing these features helps protect your capital and ensures disciplined trading, preventing emotional decision-making during volatile market conditions.

Network with Other Traders

Building connections with other traders, especially those who have experience or knowledge, can be incredibly beneficial. Engaging in discussions, sharing insights, and learning from others’ successes and mistakes can provide valuable learning opportunities. Online forums, social media groups, and local trading clubs are great places to meet fellow traders.

Be Patient and Persistent

Forex trading is not a get-rich-quick scheme, and becoming a successful trader takes time, patience, and dedication. Understand that you will face challenges and setbacks along the way. The key is to remain persistent and keep refining your approach. With time, you will build the skills and confidence necessary to succeed in the Forex market.

Conclusion

Starting in Forex trading can be daunting, but with commitment, the right education, and strategic planning, you can navigate the market effectively. Remember to focus on understanding the basics, developing a solid trading plan, and managing your risks. Utilize resources such as Latam Web Trading to enhance your knowledge and skills. By applying the tips discussed in this article, you’re setting the stage for a successful trading journey. Happy trading!