Mastering Forex Trading Systems: Key Strategies for Success

In the dynamic world of currency trading, having a reliable forex trading system Trading Broker Global can make all the difference. It’s not just about buying low and selling high; understanding the nuances of forex trading systems is crucial for long-term success. In this article, we will explore various forex trading systems, the importance of risk management, and tips to enhance your trading strategies.

Understanding Forex Trading Systems

Forex trading systems are comprehensive strategies that traders use to make trading decisions. They can range from simple rules to complex algorithms that incorporate various indicators and analytical techniques. The choice of trading system often depends on the trader’s goals, risk tolerance, and market conditions.

Types of Forex Trading Systems

- Trend Following Systems: These systems aim to capitalize on sustained market movements. Traders identify an asset’s trend and take positions accordingly, whether bullish or bearish.

- Range Trading Systems: This system is effective in sideways markets. Traders identify support and resistance levels and sell at resistance and buy at support.

- Breakout Systems: When the market breaks through critical support or resistance levels, traders may take positions expecting significant price movements.

- Scalping Systems: This is a short-term strategy where traders make numerous trades throughout the day to take advantage of small price movements.

Components of a Successful Forex Trading System

A successful forex trading system typically comprises several critical components:

- Entry and Exit Signals: Clear signals are essential to determine when to open or close a trade. This can be based on technical indicators, chart patterns, or market news.

- Risk Management: Protecting your capital is vital. Establishing stop-loss levels, position sizing, and risk-to-reward ratios should be integral to your system.

- Time Frame: Different strategies work better on different time frames. Traders must choose the appropriate time frame based on their trading style and objectives.

- Trade Journal: Keeping a detailed record of trades helps in analyzing performance and refining strategies.

The Importance of Risk Management

Effective risk management strategies are pivotal in forex trading. Even the best trading systems can lead to losses due to unforeseen market changes. Here are some principles of risk management:

- Limit Your Losses: Utilize stop-loss orders to protect against substantial losses. Set these orders according to your risk tolerance.

- Position Sizing: Never risk more than a small percentage of your trading capital on a single trade. This ensures you can withstand prolonged periods of losses.

- Diversification: Avoid putting all your capital into one trade or currency pair. Diversifying your portfolio can help mitigate risks.

- Emotional Discipline: Stick to your trading plan and avoid impulsive decisions based on emotional reactions to market movements.

Developing Your Own Forex Trading System

While many traders use established systems, developing a personalized trading system can cater to individual strengths and preferences. Here’s how to create your own:

- Identify Your Goals: Define your trading objectives and what you hope to achieve in the forex market.

- Anita communicate methodologies: Research various trading methodologies and adopt elements that resonate with you.

- Backtest Your System: Use historical data to test your trading strategy’s effectiveness before implementing it in live trading.

- Review and Adjust: Continuously monitor the performance of your system and make necessary adjustments based on changing market conditions.

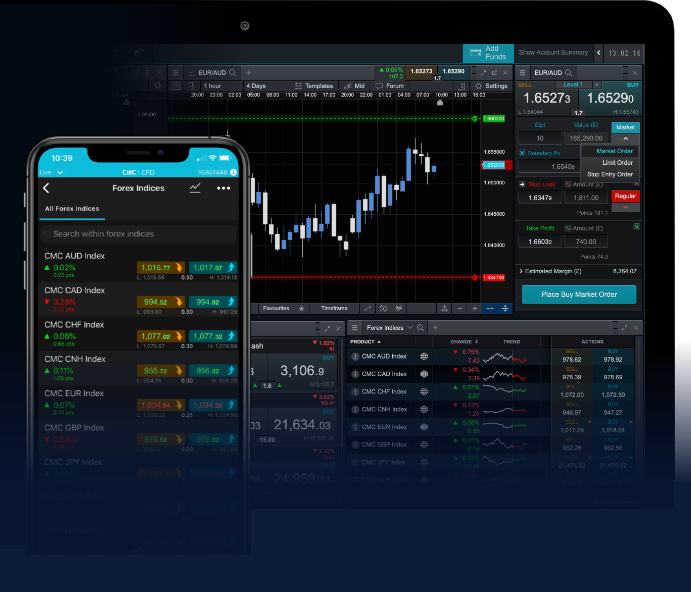

Utilizing Technology in Forex Trading

In today’s digital age, technology plays a significant role in forex trading. Various software and tools can help traders develop and implement their trading systems effectively:

- Trading Platforms: Platforms like MetaTrader 4 and 5 offer advanced charting tools and technical analysis options.

- Automated Trading Systems: Many traders leverage algorithmic trading to execute trades automatically based on predefined criteria.

- Trading Signals: Services that provide trading signals can help traders make informed decisions based on expert analysis.

- Market Analysis Tools: Utilize various tools for fundamental and technical analysis to gauge market trends accurately.

Conclusion

Mastering forex trading systems requires dedication, continuous learning, and refining strategies over time. By understanding the components of effective trading systems, implementing solid risk management practices, and utilizing technology, traders can enhance their chances of success in the forex market. Remember, there are no guarantees in trading, but with a well-thought-out plan and disciplined execution, traders can navigate the complexities of the forex world with confidence.